Secure share: Commonly asked questions

Published

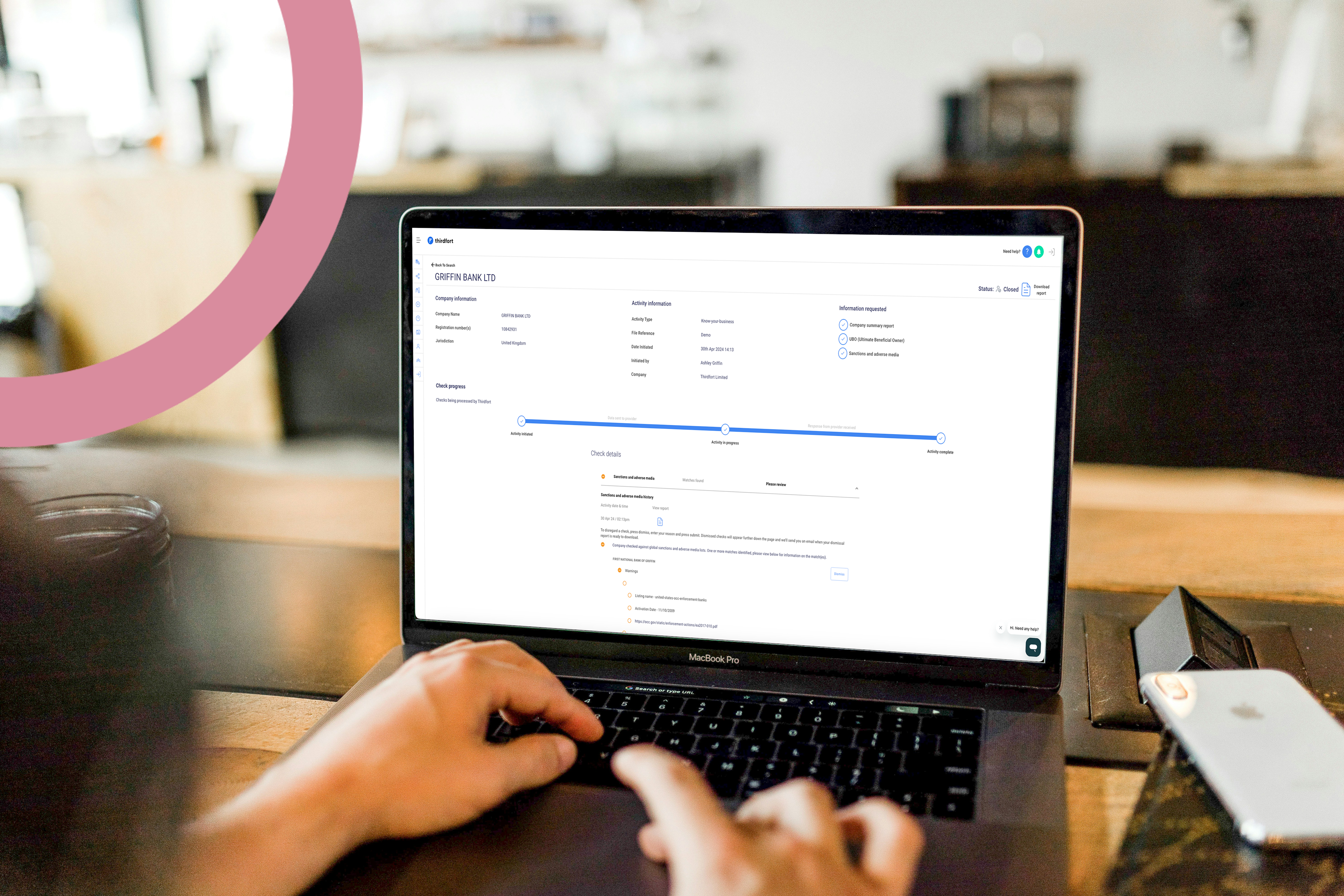

With Thirdfort’s Secure share feature, you can share completed ID and AML reports and unlock more customer referrals. Your clients will no longer have to repeat the same checks over and over again. That means more business for you and a better experience for your clients.

The concept of sharing ID and AML reports between regulated professionals is still relatively new and understandably you may have a number of questions about how it works for you and your clients. Here we tackle some of the key questions we tend to be asked.

How does it work?

How do we gather consumer consent?

When a consumer starts the Thirdfort app journey they agree to our EULA, consent to the processing of their biometric data and are presented with our privacy policy, which both address the fact that the information provided may be shared with an advisor or advisors. To encourage transparency we require clients to obtain written consent from the consumer before sharing with another firm.

You may want to update your client care information to include this information. Explain to clients that this means they won’t need to repeat checks over and over. For example, you could say,

"As part of due diligence, we are legally required to check our client's details and identity. To complete these checks, we use Thirdfort. Thirdfort allows you to verify your identity and the Source of your funds, remotely, quickly and safely. Historically during the property transaction process, you will be asked to complete this type of verification multiple times, which can be repetitive and time-consuming. If you agree, we can share your completed ID and AML reports with your chosen conveyancer. This means you will not need to repeat the same checks multiple times. You can find Thirdfort’s Privacy Agreement at https://www.thirdfort.com/privacy/."

How long after a report is completed can it be shared for?

There isn’t a limit to how long after your client completes their tasks that a report can be shared.

Before you share a report you are told how many days ago the report was completed. You can make a decision on whether you are still happy to share a report.

If you receive a shared report from another firm you are told the date the report was completed on as well as how many days ago this was. You can then decide to accept or reject the shared report based on your firm’s policies, controls and procedures.

If you need to request further information from the client, like more up to date proof of address document or Source of Funds information, you will have the phone number and name of the client shared with you as part of the shared ID and AML report you have received. This will allow you to request this information via Thirdfort, meaning your client only needs to use one app to share their information with you in a secure way.

AML screening and ongoing monitoring: How does this work?

If you initiate a report on your client we will automatically screen them against hundreds of live databases to determine if they are a sanctioned individual, a politically exposed person or if they appear on any warnings or fitness probity lists. If you have turned on ongoing monitoring then we will alert you instantly to any changes to your client’s status.

With Thirdfort you can also review and dismiss any screening matches that you believe are false positives. We create an audit trail of this along with your reasons for dismissing any matches. If you share your client’s report with a third-party we will share the first version of the report with them. This means the third-party will not see that you have dismissed any screening matches. Crucially, it is up to them to make their own decisions based on their firm’s risk-based approach and engagement with the client.

Currently, if you receive a shared report from another party you will not receive ongoing monitoring alerts. This is something we’re actively working to upgrade. If you need ongoing monitoring we suggest you use our standalone screening tool after receiving the shared report. This will mean your client will not need to complete any further checks and you will be able to switch on ongoing monitoring.

Does the third-party I share the report with need to have a Thirdfort account?

For privacy and security reasons, shared reports can only be accessed by Thirdfort clients. But that doesn’t mean that you can’t share reports with your industry partners who do not currently use Thirdfort.

If you share a report with another firm who do not currently use Thirdfort we will still notify them via email that a report has been shared with them. By following the link in the email they can contact us and one of our team can get them set up with a new account. They will then have access to the report that you have shared with them.

Want to hear more about the benefits of sharing ID and AML reports? You can read what our clients have to say or watch the video below.

Subscribe to our newsletter

Subscribe to our monthly newsletter for recaps and recordings of our webinars, invitations for upcoming events and curated industry news. We’ll also send our guide to Digital ID Verification as a welcome gift.

Our Privacy Policy sets out how the personal data collected from you will be processed by us.