You do the deals, we do the verification

Our range of automated ID verification, anti-money laundering and Know your business checks are now available with MRI Software. Thirdfort protects life’s big transactions so you and your clients can move fearlessly.

See how Thirdfort works

Why use Thirdfort?

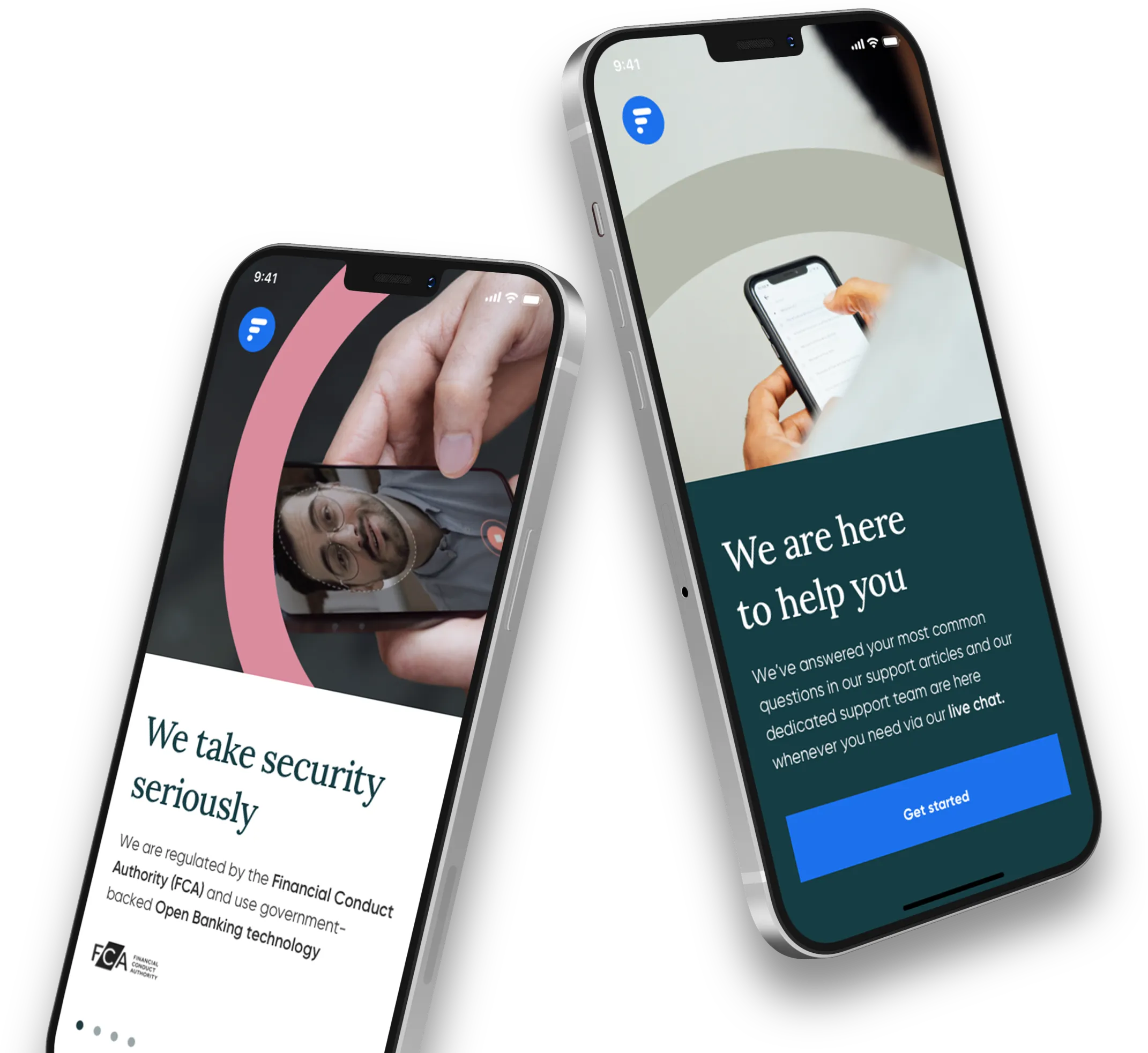

We'll handle client queries

If your client has any questions our award-winning support team are on hand to help.

Speedy verification

75% of clients complete their checks in under 24 hours.

Compliant

KYC and AML verification that meets HMRC’s requirements.

Having a platform which obtains digital ID, AML and source-of-funds verification gives our sales teams time back to focus on selling."

It offers our clients and staff a more streamlined and secure approach to KYC, AML and Source of funds checks."

Three steps to get started

Our product

ID Verification

Digital ID verification including AML screening, electronic proof of address and proof of ownership checks, all in one secure app.

Source of Funds

Gain instant and secure access to six months of your clients' bank statements, with red flags highlighted for you.

PEPs and Sanctions

We tap into thousands of live data sources to screen individuals and companies, so you know exactly who you’re dealing with.

Know your business

Get the full picture on your business clients with rapid and reliable beneficial owner results in an easy-to-use report.

What's included in your ID checks?

See for yourself

Download a demo report to see what you'll receive once clients complete their checks.

How do your Source of Funds checks work?

What can I send clients?

We find that clients complete their checks faster if you have told them they'll be asked to verify their ID before you send them the check. We recommend sending them this guide to help.

Learn more

AML ComplianceOpinionRegulations

AML ComplianceOpinionRegulationsMastering AML compliance: Q&A for Estate Agents

Read more

Read more

AML ComplianceOpinionTechnology

AML ComplianceOpinionTechnologyThree communication tips to help transform your compliance culture

Read more